Your Invoices. Processed Autonomously. From Capture to Payment.

Five AI agents work in sequence to capture, validate, match, approve, and post invoices — without templates, without manual intervention. Subscribe, connect your ERP, and go live in 8 weeks. Zero infrastructure overhead. Continuous updates. No upgrade cycles.

- 1 Capture Agent — Template-free data extraction

- 2 Validation Agent — 20+ business rule checks

- 3 Matching Agent — 2/3-way PO & GRN matching

- Green Channel — Auto-approve trusted vendors

- 4 Approval Agent — Smart routing & escalation

- 5 Posting Agent — Bi-directional ERP sync

Five AI Agents. One Autonomous Invoice Workflow.

Each agent handles a discrete stage of the AP lifecycle. Invoices flow through the pipeline automatically — from capture to ERP posting — with human intervention only when the system flags a genuine exception.

Template-free data extraction from any invoice format — scanned, PDF, email, portal, or API. Multi-language and multi-currency support with AI-powered field recognition that learns and improves with every document processed.

Runs 20+ business rule checks in real time — verifying GST, PAN, TDS, and e-invoicing compliance against government databases. Catches duplicate invoices, flags mathematical errors, and validates vendor registration status before anything moves forward.

Performs intelligent 2-way and 3-way matching across purchase orders, goods receipt notes, and invoices — including tolerance-level handling, variance analysis, and automatic multi-plant matching for enterprises with distributed operations.

Routes invoices through configurable multi-level approval hierarchies with email-based one-click approvals, auto-delegation on absence, and department-specific workflows. The system adapts to your organisational structure — not the other way around.

Bi-directional integration with your ERP — SAP ECC/S4HANA, Oracle EBS, Microsoft Dynamics, Tally, or custom systems. Automatically generates journal entries, applies payment terms, tracks early-payment discounts, and syncs vendor master data in real time.

Capabilities You Won't Find in Generic AP Tools

Built for the complexity of Indian and Middle Eastern enterprises — not retrofitted from a Western product.

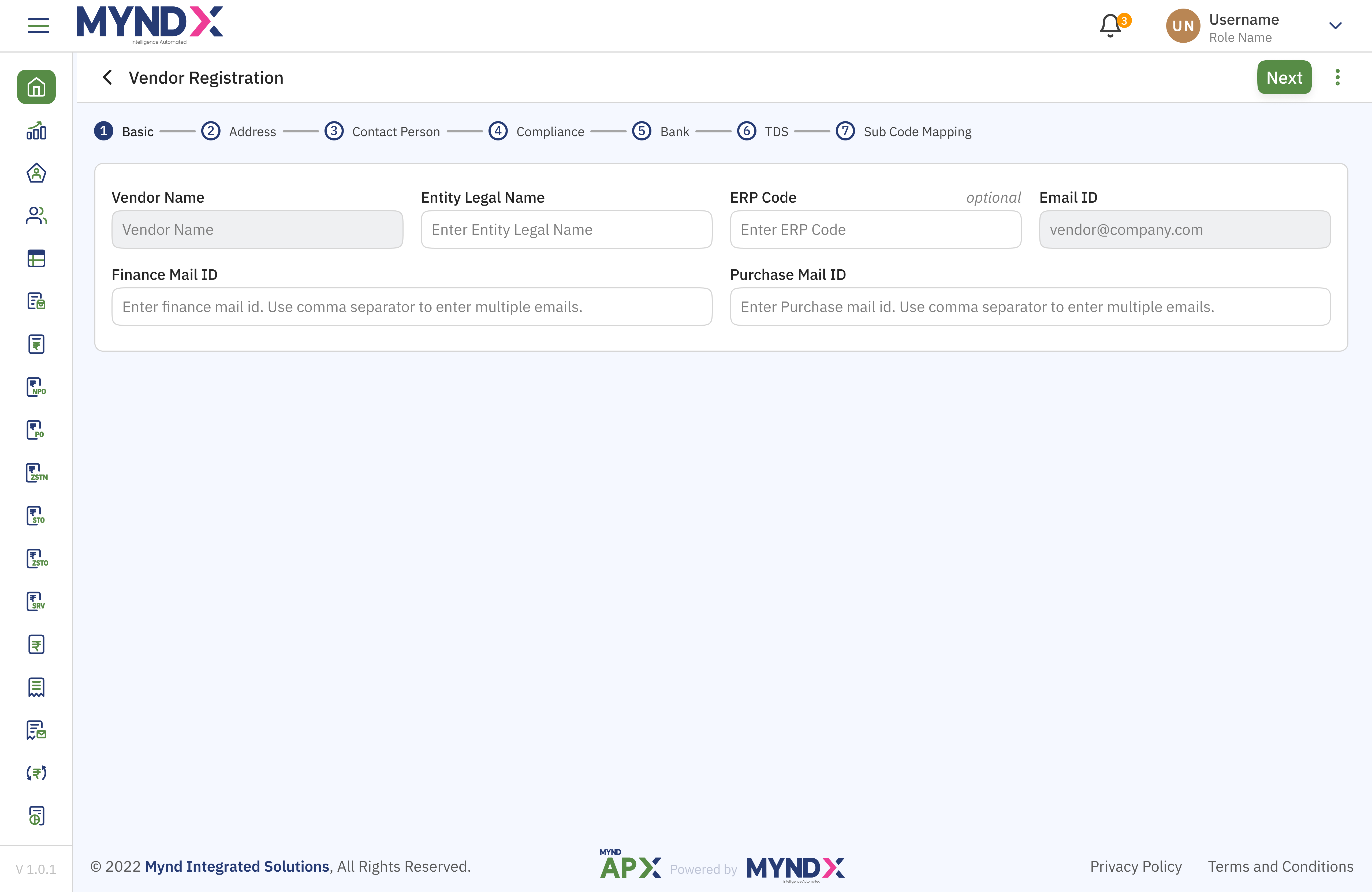

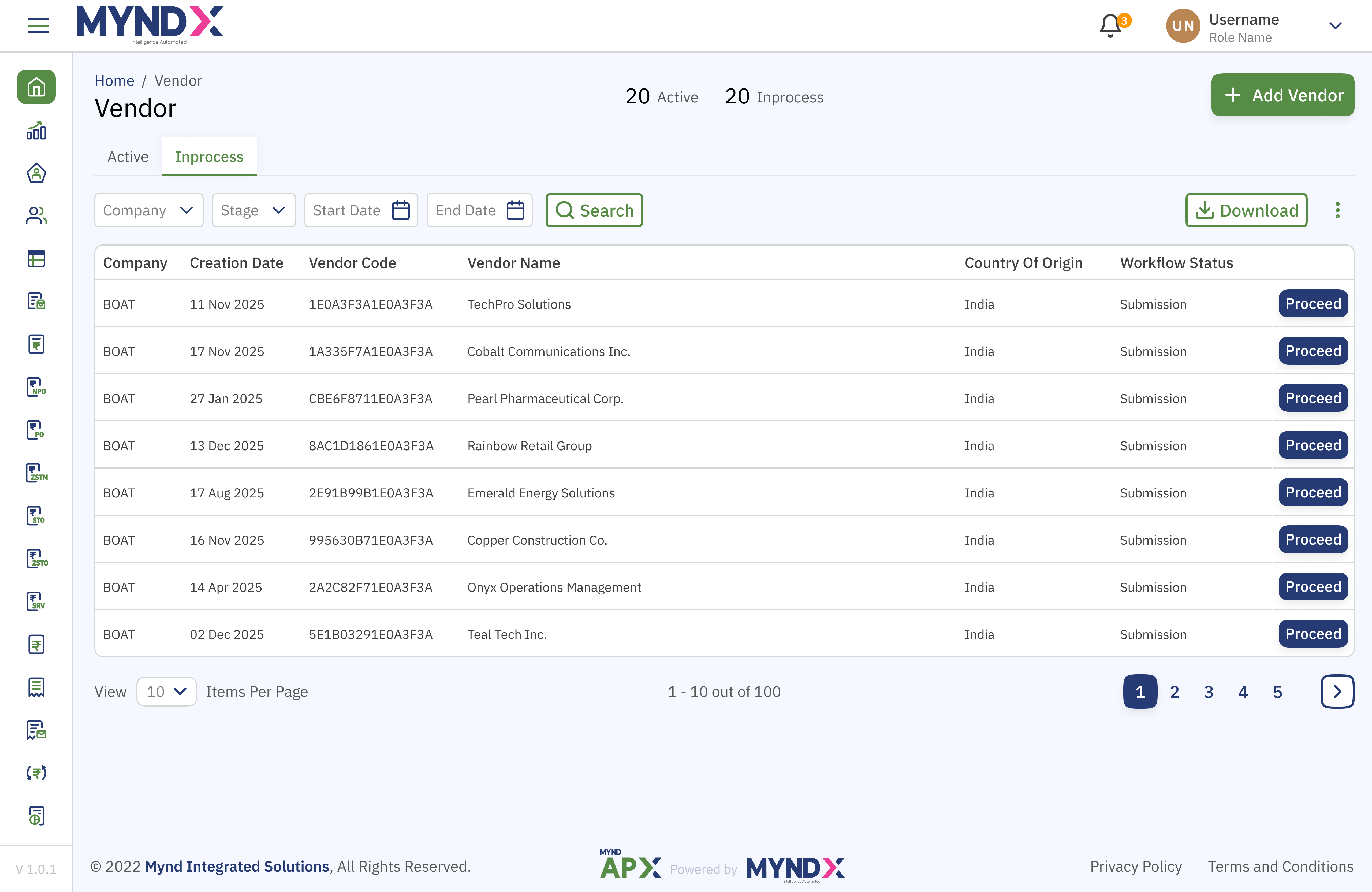

Vendor Self-Service Portal with Digital KYC

Vendors self-register through a branded portal. MYNDAPX auto-verifies PAN, GST, and bank account details against government databases in real time — eliminating manual vendor onboarding and reducing vendor queries by 70%.

Bill of Entry Automation (India-Specific)

ML-powered extraction of customs data from Bills of Entry. Tracks import licences, matches with ERP records, and automatically generates category-wise accounting entries — a capability purpose-built for India's import compliance landscape.

8-Week SaaS Deployment

Where typical enterprise AP implementations take 3–6 months, MYNDAPX goes live in 8 weeks — including discovery, configuration, ERP integration, data migration, testing, and user training. Cloud-native SaaS means no infrastructure setup, no version upgrades, and ROI within 6–8 months.

Inside the MYNDAPX Platform

Walk through each stage of the AP automation workflow — from vendor onboarding to ERP posting.

Step 1: Vendor Onboarding

Vendors self-register through a branded portal. MYNDAPX auto-verifies PAN, GST, and bank details against government databases — making vendor onboarding a zero-touch process.

- Self-service vendor registration portal

- Digital KYC with real-time government verification

- Configurable approval workflows for new vendors

- Real-time status tracking for vendors

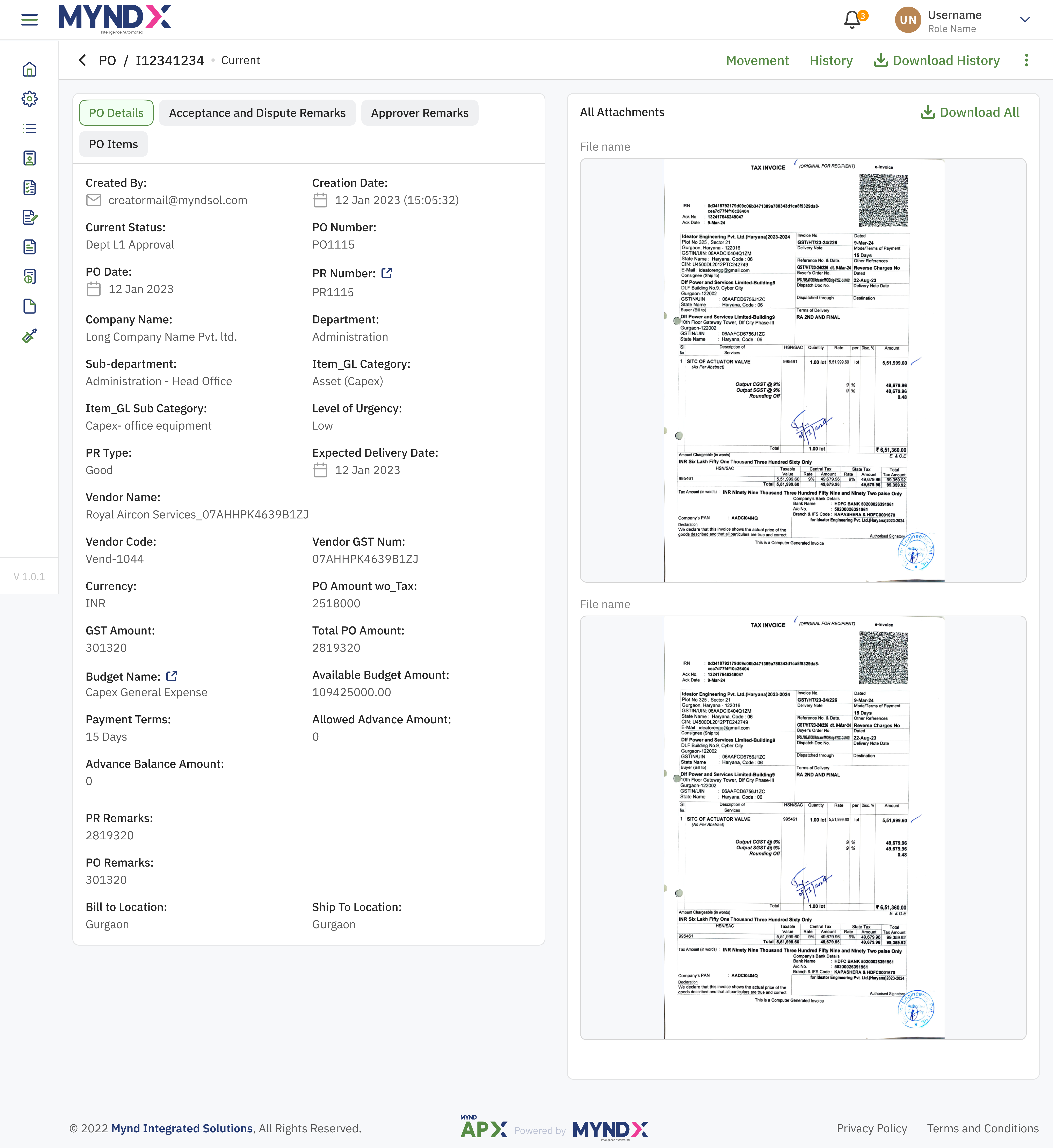

Step 2: Purchase Requisition & Purchase Order

Create and manage purchase requisitions with multi-level approvals, then convert to purchase orders with automatic budget checks and vendor allocation.

- Multi-level PR approval workflows

- Automatic budget validation

- PO generation from approved PRs

- Vendor rate comparison and allocation

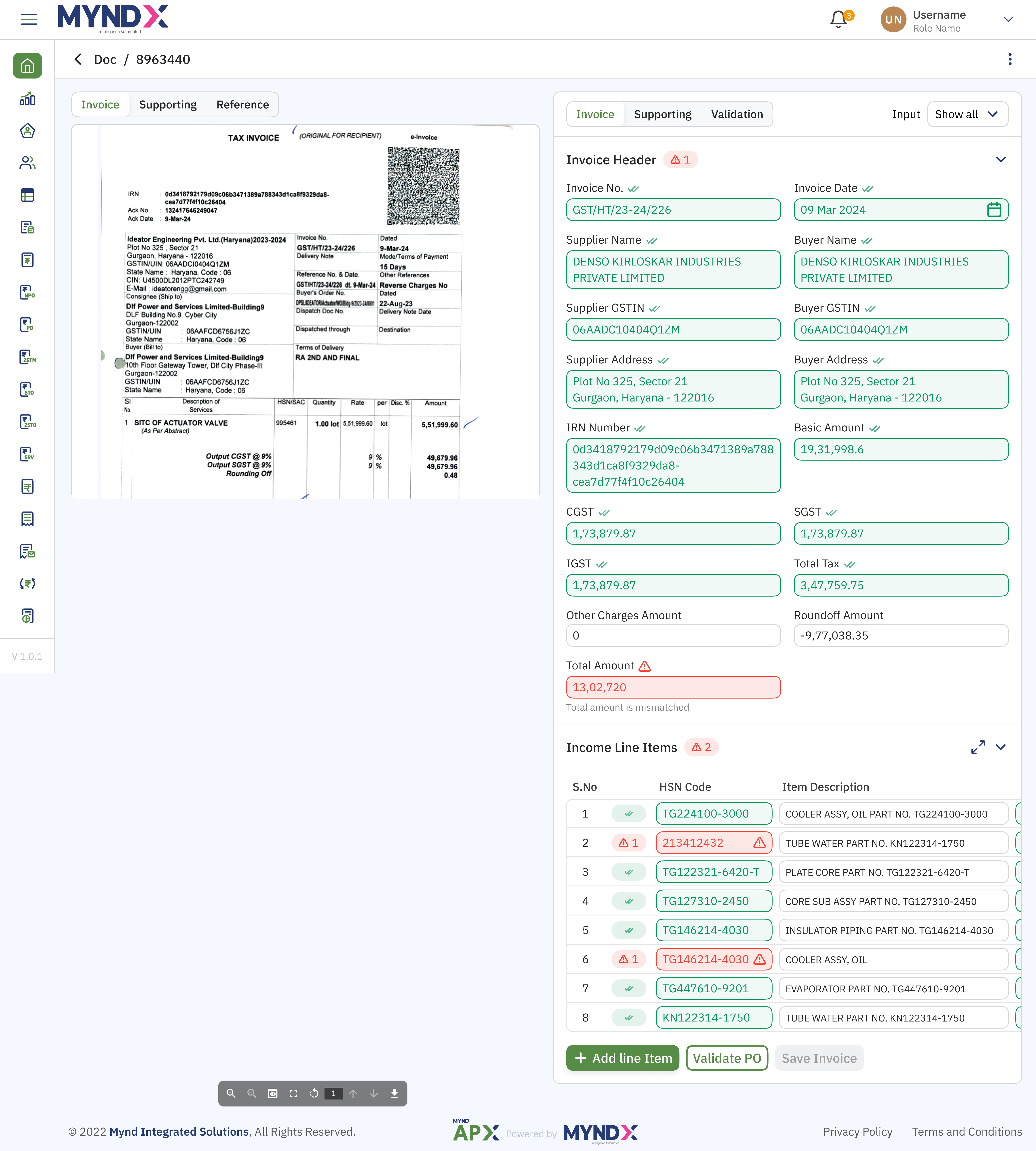

Step 3: AI Document Processing

Template-free intelligent extraction powered by AI and ML. MYNDAPX reads any invoice format — scanned, digital, or email — and extracts header, line items, and tax data automatically.

- Template-free data extraction

- Header + line-item recognition

- GST, TDS, and e-invoicing validation

- Duplicate invoice detection

Step 4: 2-Way & 3-Way Matching

Intelligent matching of invoices against POs and GRNs with configurable tolerance levels, variance analysis, and automatic exception routing.

- Configurable match tolerance levels

- Variance analysis with drill-down

- Multi-plant GRN matching

- Exception routing for mismatches

Step 5: Approval & ERP Posting

Configurable approval workflows with email-based one-click approvals and Green Channel for trusted vendors. Approved invoices post directly to your ERP with bi-directional sync.

- Multi-level approval hierarchies

- Green Channel auto-approval for trusted vendors

- Bi-directional ERP integration

- Automatic journal entry generation

Measurable Impact Across Every Metric That Matters

Case Studies

See how MYNDAPX delivers measurable results for enterprises across industries.

Digitizing Vendor Invoice Processing for Diagnostic Supply Chains

300+ diagnostic centers. 80%+ touchless invoice processing. Complete compliance automation across a distributed healthcare operation.

Read Case Study HealthcareDigitizing Vendor Invoice Processing for Dialysis Supply Chains

500+ clinics. 95% faster turnaround. End-to-end AP automation for a nationwide dialysis network with multi-location compliance.

Read Case Study Real EstateBuilding the Future of Real Estate Finance with AP Automation

End-to-end AP transformation for a real estate developer — from manual invoice handling to automated capture, matching, and ERP posting.

Read Case StudyPurpose-Built for Your Industry's AP Complexity

MYNDAPX adapts its SaaS workflows to the specific compliance, vendor, and approval patterns of your industry.

Manufacturing

Handle complex multi-plant operations with automated GRN matching, multi-location tax compliance, and configurable capex approval workflows.

- Automatic GRN matching across multiple plants

- Multi-location tax structure handling

- Capital expenditure multi-level approvals

- Material management system integration

Multi-Plant Operations

Centralized visibility across plants and supplier categories

Hospitality & Food Chains

Manage high volumes of invoices across hundreds of outlets with location-wise tracking, aggregator reconciliation, and standardized processing.

- Location-wise expense tracking and vendor performance

- Rate contract validation against purchase orders

- Standardized processing across all locations

- Aggregator and platform invoice reconciliation

Multi-Outlet Operations

Standardized AP processing across 100s of locations

Telecom & Infrastructure

Handle milestone-based vendor payments, SLA reconciliation, and project hierarchy approvals across large-scale infrastructure deployments.

- Milestone-based payment tracking

- SLA-based vendor reconciliation

- Project hierarchy approval workflows

- Large vendor network management

Project-Based AP

Milestone payments and SLA-driven reconciliation

E-Commerce & Retail

Match delivery challans with invoices, manage store-level budgets, and integrate with POS systems for seamless retail AP operations.

- Delivery challan matching with invoices

- Store-level budget management and controls

- POS system integration

- High-volume seasonal scaling

Retail AP

Store-level controls with centralized processing

IT & ITES

Manage subscription and license invoices, timesheet-based vendor billing, and multi-currency processing for global operations.

- Subscription and license invoice handling

- Timesheet-based vendor validation

- Multi-currency processing

- Project-based cost allocation

Technology AP

Subscription management and multi-currency support

Healthcare & Pharma

Handle regulatory-compliant invoicing, equipment contract management, and department-level budgeting across hospitals and clinical networks.

- Regulatory compliance for medical procurement

- Equipment and service contract management

- Department-level budget controls

- Multi-entity consolidation

Healthcare AP

Compliant procurement across clinical networks

Plug Into Your ERP. No Middleware Required.

MYNDAPX's cloud-native SaaS architecture connects bi-directionally with your existing ERP — syncing vendor masters, purchase orders, GRNs, and journal entries in real time. No on-premise infrastructure to manage.

SAP ECC / S4HANA

Certified integration for FI, MM, and Ariba modules with real-time sync

Oracle EBS / Cloud

AP, PO, and GL modules with automated journal posting

Microsoft Dynamics

D365 Finance & Operations with Azure-based integration

Tally / QuickBooks / Zoho

India's most used accounting systems with RESTful API sync

Bi-Directional Sync

Changes in your ERP reflect in MYNDAPX and vice versa — in real time, not overnight batches.

RESTful APIs

Open APIs for custom integrations with any system — no vendor lock-in, full interoperability.

Zero Infrastructure

Cloud-native SaaS delivery means no middleware, no servers, and no maintenance overhead on your side.

Accounts Payable Automation FAQs

Everything you need to know about implementing MYNDAPX as your AP automation platform.

Product & SaaS Delivery

Is MYNDAPX a SaaS product or an implementation project?

MYNDAPX is a 100% cloud-native SaaS product. You subscribe, we configure it for your workflows, connect it to your ERP, and you're live in 8 weeks. There's no on-premise infrastructure to manage, no version upgrades to plan, and no middleware to maintain. You always run on the latest version with continuous updates delivered automatically.

How is MYNDAPX priced?

MYNDAPX uses a subscription-based pricing model that scales with your invoice volume. You pay a predictable monthly or annual fee based on your processing volume — no per-seat licences, no hidden implementation charges. This consumption-based approach means you only pay for what you use, and costs scale naturally as your business grows.

What does the 8-week deployment include?

The 8-week timeline covers discovery and scoping, workflow configuration, ERP integration (SAP, Oracle, Tally, etc.), vendor portal setup, data migration, UAT testing, user training, and go-live support. Post go-live, our customer success team provides ongoing optimisation and support as part of your subscription.

AI & Automation

What is Green Channel processing?

Green Channel is MYNDAPX's machine-learning capability that learns each vendor's invoicing patterns over time. When a trusted vendor submits a consistently clean invoice — matching historical patterns in format, amounts, and compliance — the system automatically green-channels it past the approval queue. This eliminates the bottleneck for routine invoices while keeping full audit trails and exception handling for anything unusual.

Does MYNDAPX require templates for invoice capture?

No. Our AI-powered Capture Agent uses machine learning and natural language processing to extract data from any invoice format — scanned PDFs, digital documents, email attachments, or vendor portal submissions. The system learns and improves with every document processed, achieving 99%+ extraction accuracy without any template configuration.

Compliance & Security

Does MYNDAPX handle Indian GST, TDS, and e-invoicing compliance?

Yes. MYNDAPX's Validation Agent performs real-time verification against government databases — checking GSTIN status, PAN validation, TDS applicability, and e-invoicing compliance. It also automates ITC reconciliation and handles the complexity of multi-state GST requirements. Updates to tax rules are pushed automatically through our SaaS delivery model — no manual patches needed.

What security certifications does MYNDAPX hold?

MYNDAPX holds ISO 27001:2013 certification for information security management, plus SOC 1 Type II and SOC 2 Type II attestations. All data is encrypted at rest and in transit using AES-256 encryption. Our cloud infrastructure provides automated backups, disaster recovery, role-based access controls, and comprehensive audit logging.

Integration

Which ERP systems does MYNDAPX integrate with?

MYNDAPX has pre-built connectors for SAP ECC and S/4HANA, Oracle EBS and Cloud, Microsoft Dynamics 365, Tally, QuickBooks, and Zoho Books. For custom or legacy systems, we provide RESTful APIs for bi-directional integration. Integration typically completes within the 8-week deployment timeline with no additional infrastructure required.

Ready to Eliminate Your AP Bottleneck?

See MYNDAPX process your actual invoices in a live demo. 8-week deployment. Subscription pricing. No infrastructure overhead. ROI in 6–8 months.

.png)

.png)

.png)

.png)